For a period of more than 100 days, travel professionals around the world have been striving to make sense of the ever-changing global conversation surrounding COVID-19.

ILTM has no crystal ball, but whilst we can’t predict the future, our unique and close ties with buyers from around the globe gives us the next best thing: insight and data.

Throughout this crisis, buyers, armed with industry experience and knowledge of past sector upheavals, have been talking to their clients constantly. Keen to tap into this unrivalled knowledge source, ILTM created the 2020 Buyer Research Survey and want to share with you the optimistic, yet realistic, findings therein.

Current Booking Behaviours

The ILTM Buyer Research Survey ran between the 4th-18th June 2020 and went out to over 4,000 buyers from shows within the ILTM Collection, including Cannes, North America, Asia Pacific, China and Africa. The response was overwhelming and comprised of a majority of buyers in senior positions as private travel designers (35%) or within retail travel agencies (34%), among many others.

The crux of this research was to establish a number of core elements. Firstly, ILTM were keen to gather insight into the current needs and behaviours of the globe’s wealthy travellers. Additionally, we wanted to establish any fundamental barriers when it came to the idea of travelling again, and the changes in travel preferences that may be a side-effect of this. To that aim, one of our pivotal questions was determining the current demand for travel during this pandemic. Somewhat surprisingly, the volume of bookings buyers had received since the start of the outbreak was not as bleak as perhaps feared. It was found that 6 out of 10 buyers (64%) have received bookings since the start of the COVID-19 crisis, a result that was most prevalent in the Americas, Russia and Europe.

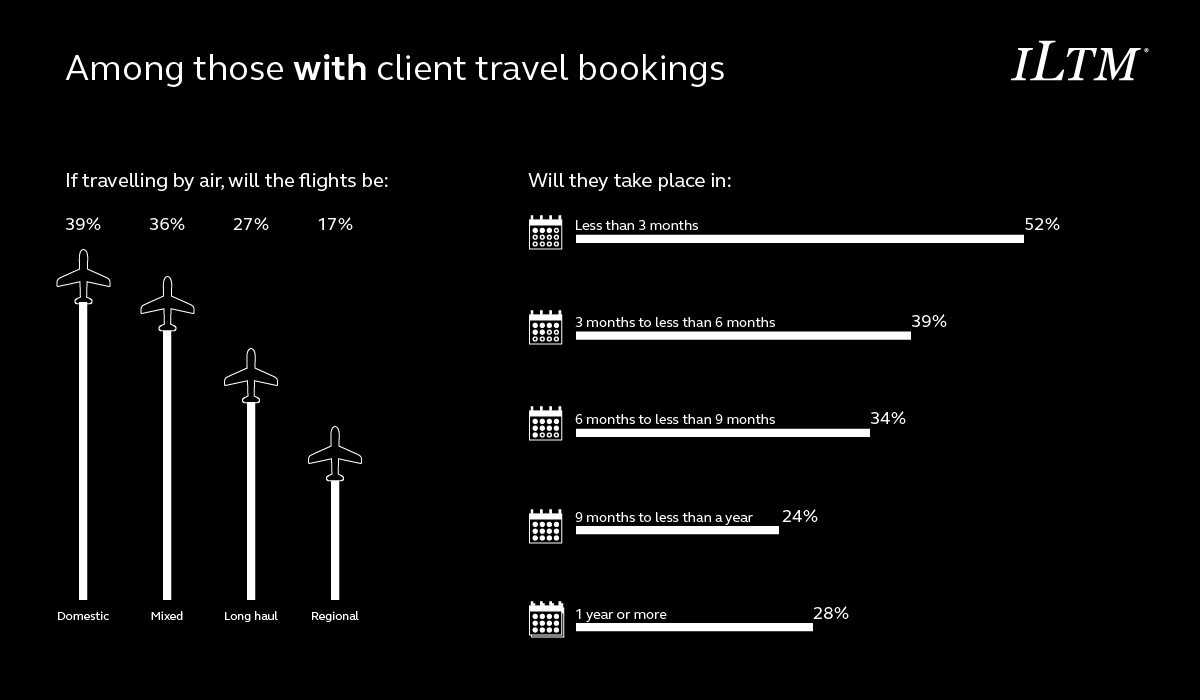

However, these figures don’t imply that those who are travelling are jumping in with both feet just yet. Of those clients willing to travel by air, for example, the majority (39%) are travelling domestically with 27% taking long-haul flights. Whilst this still represents a huge hit to revenues, it is certainly a step in the right direction and becomes increasingly positive when we apply time frames to when these bookings will take place.

Notably, it was revealed that just over half of the bookings made (52%) are taking place in less than 3 months’ time. The next increment of which at 39% are occurring in 3 to less than 6 months’ time. Despite the ongoing uncertainty and a reluctance of many to travel internationally as of yet, this swift return to travelling at all is undoubtedly a relief and it is not the only sign of latent demand that the industry is displaying.

Popular Destinations And Shifting Travel Preferences Among HNWI

When looking at the destinations chosen by clients, these too show a slow return to some key areas. European travellers, for example, are especially confident, with locations such as Greece, France, Spain, Italy and the Maldives all being among the booked choices.

For clients of APAC buyers, Australia, China, New Zealand, Europe and Africa were the top picks. When we consider the type of getaways that are being booked, the data continues to show some clear themes, with beach escape holidays being the overall most common type at almost 70% across all buyer regions save for APAC, possibly due to them having this type of landscape readily available domestically. Unsurprisingly too, family holidays were the second most prominent type of trip being booked at 55% and private villa trips were next in line in this data set at 42%. In light of the lockdown and the separation from family that we have had to endure, the surge in family bookings shows the key role that our industry will play in bringing loved ones back together.

Of course, what’s important to note here is that despite travel being a complicated business right now, we are not seeing a big impact on the desire to travel and this is supported time and again by the buyer research. As we’ve seen, clients are still willing and wanting to fly, with even a significant number willing to travel long-haul. For those who are still uneasy though, the response has for the most part not been to halt travel but to instead adapt and in many cases move to more private means. Of those buyers who have had bookings since the start of the pandemic, it was reported that 59% of clients were considering cars as an alternative mode of transport. It was also found that across the ILTM collection of buyers, those with bookings also reported that 22% of clients were considering other forms of travel which included private options such as jets, planes and yachts among others.

The Barriers To Travel And The Return Of Bookings

To further analyse these behaviours, we asked buyers to outline what they felt were the key barriers for clients to overcome in terms of travelling and unsurprisingly, health concerns and quarantine rules emerged equally at 64% as being the core reasons that many clients felt unable or unwilling to travel.

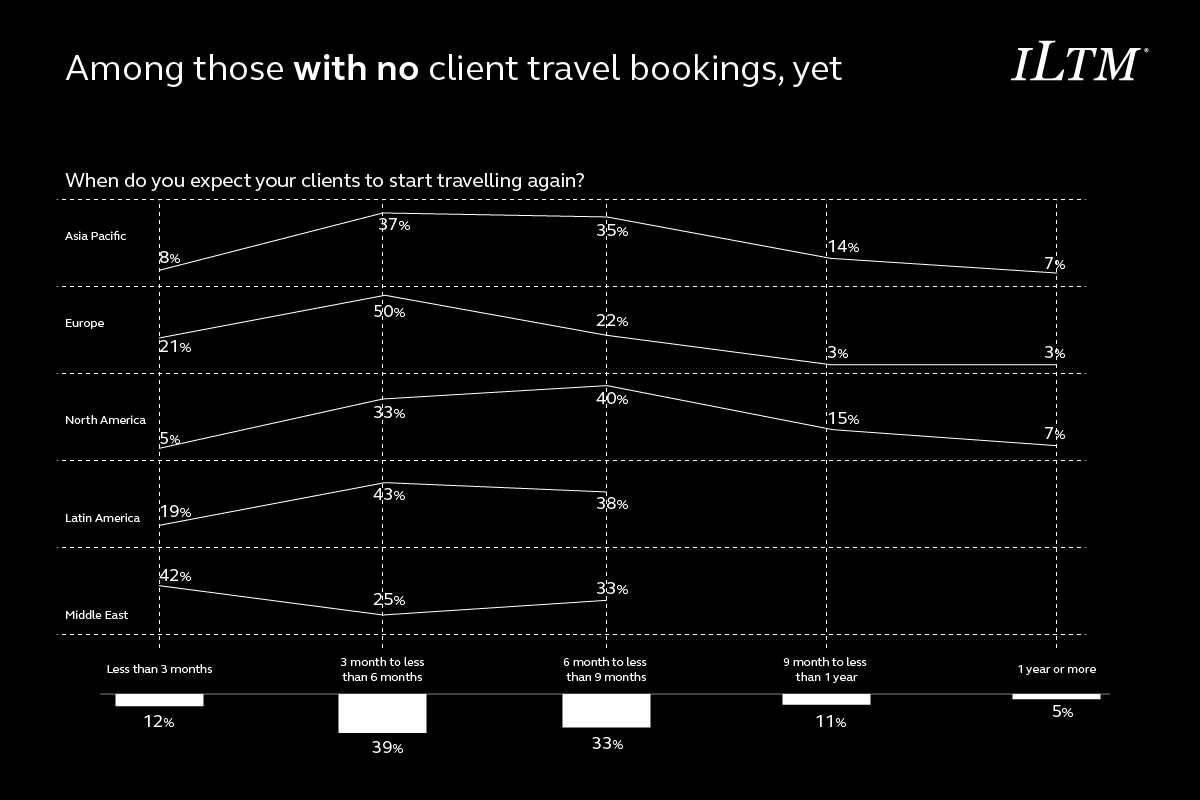

In spite of the barriers highlighted by buyers being seemingly hard to navigate or influence, the general optimism from buyers, even those who had not yet received any bookings, was significant. For example, when buyers who had yet to receive any bookings were asked to make an educated estimation on when they expect their clients to start travelling again, a huge 72% anticipate a climb in bookings in 3-9 months. When this data is drilled-down into, and reflective of the overall numbers, Asia Pacific buyers are split between thinking this change will be between 3-6 months and 6-9 months, whereas half of the European buyers are certain bookings will have an upsurge in 3-6 months.

By comparison, buyers from the Middle East are predicting things to happen much sooner, with 42% foreseeing more bookings in less than 3 months. Interestingly, 40% of North American buyers who have not had bookings are estimating a 6-9 month window for increased bookings despite North American buyers as a whole being graced with the most number of bookings in total.

These relatively short-term turnaround estimations reveal a confidence that the industry couldn’t imagine back in March. In a similar vein, when asked to estimate just when they thought the luxury travel industry would be able to rebuild there was overwhelming positivity. 50% of buyers from all of the ILTM Collection shows expected the luxury travel industry to return within a year. A further 38% expect this recovery to take up to two years, with Chinese buyers the most likely to state the longer time frame. European buyers, in particular, revealed a high confidence level at 51% predicting a sub-two-year time frame.

What the Industry Needs and the Journey Ahead

All of this culminates in something ILTM have firmly believed throughout: even in what can feel like the darkest hour for the luxury travel industry, buyers from across the entire ILTM Collection are telling us that while bookings have slowed and are less profitable, the fundamental desire to travel has not. Travellers are not only booking trips amid the ongoing crisis (52% within the next 3 months), but over 50% of buyers are also confident that the luxury travel industry will have returned within a year.

Of course, this is a global view and therefore the results don’t always account for the distinct and often stark regional differences that we are all still experiencing. Many of our colleagues and clients are operating within regions that do not yet feel the light at the end of the tunnel. But, with our flagship event ILTM in Cannes on the horizon in 6 months’ time, it seemed more important than ever to release these figures to meet the clear demand and desire of buyers and their clients the world over.

With the right set of circumstances ahead of us, we now believe it will be possible to deliver the show that the industry needs at the time the industry needs it this coming December.

As one buyer put it: “I am honestly hoping (and other partners I talked to feel the same) that ILTM in Cannes will happen as it is one of the most important places to meet with partners. We are very keen to have the possibility to connect and meet in person again after such a long time”.—2019 ILTM Cannes Buyer, Europe

ILTM Cannes will be the key to kick-starting that travel come December and for that reason, we are delighted to be beginning the journey towards our 2020 event. Our hope for Cannes 2020 is not only that it meets the ever-growing demand but also provides some much-needed respite to what has been a tough year. You will be hearing from us again very soon.

The ILTM team look forward to seeing you there.

AMAZING !!! – ILTM Cannes will be the restart of our industry !!!

Dear Allison, what a positive message in times like this! So happy to hear that ILTM Cannes most probably will take place – for me and my company it’s the most important event to meet suppliers. As mentioned during the survey,there is no show like this to meet partners for our high-end clientele! Let’s hope the suppliers will be able to travel from different parts in the world! Once again – thanks for These great News, stay safe – best regards, Lotte

Dear Allison, what a positive message in times like this! So happy to hear that ILTM Cannes most probably will take place – for me and my company it’s the most important event to meet suppliers. As mentioned during the survey,there is no show like this to meet partners for our high-end clientele! Let’s hope the suppliers will be able to travel from different parts in the world! Once again – thanks for These great News, stay safe – best regards, Lotte

None of the statistics include the US market, and the fact that very few countries are allowing US citizens entry. Hopefully the US will make progress in getting the pandemic under control, but if it’s still more rampant than hoped, will US buyers even be allowed to travel to France?

I think it is very important to have this event to restore trust and confidence in over own selves and of course most importantly our clients . By bringing all of us together ILTM would benefit in several ways . By meeting in person , to get on that flight , the smell , the noise , the people . we need it all .ILTM id the best platform to get everyone together say bye bye to 2020 and kick off great 2021 . I am really looking forward to attending the event , it is one of my most important event in any case but this year it is even more special . I want to be there for sure

Thank you so much, ILTM.

Love your shows and they are the best offered to us.

The shows must go on…

Thanks so much for your kind words Amy, indeed it must!

For me personally, ILTM Cannes at the moment is the most expected event. All of us extremely need it. We need to open our wings and fly again.

I believe it will happen soon.

All our clients have been waiting to get the green signal for international travel and we surely see a surge in Luxury buyings going further with private jet charters & buy outs !!!

COVID-19 has been lasting since beginning of 2020 which resulted huge loss in terms of economy and travel industry and out of the expectation of the world. We monitor the situation the changes worldwide and hope the virus could be over soon. Meanwhile we have been keeping active contacts by attending on line lectures on different travel products to gain more knowledges. We are confident in tourism with gradual improvement of virus especially on future luxury travel market. See you in Cannes 2020

Hi Alison,

It is lovely to read the update from you on future of travel. Last 5 months have been heartbreaking for the travel industry and with no certainty of the near future. However the you have shared a positive perspective which is much needed to kick start luxury travel again and forget the past.

I really look forward to the event in December which for me is the most important business marketplace.